**Must-Know Facts: Are Baby Helmets Insurance Covered?**

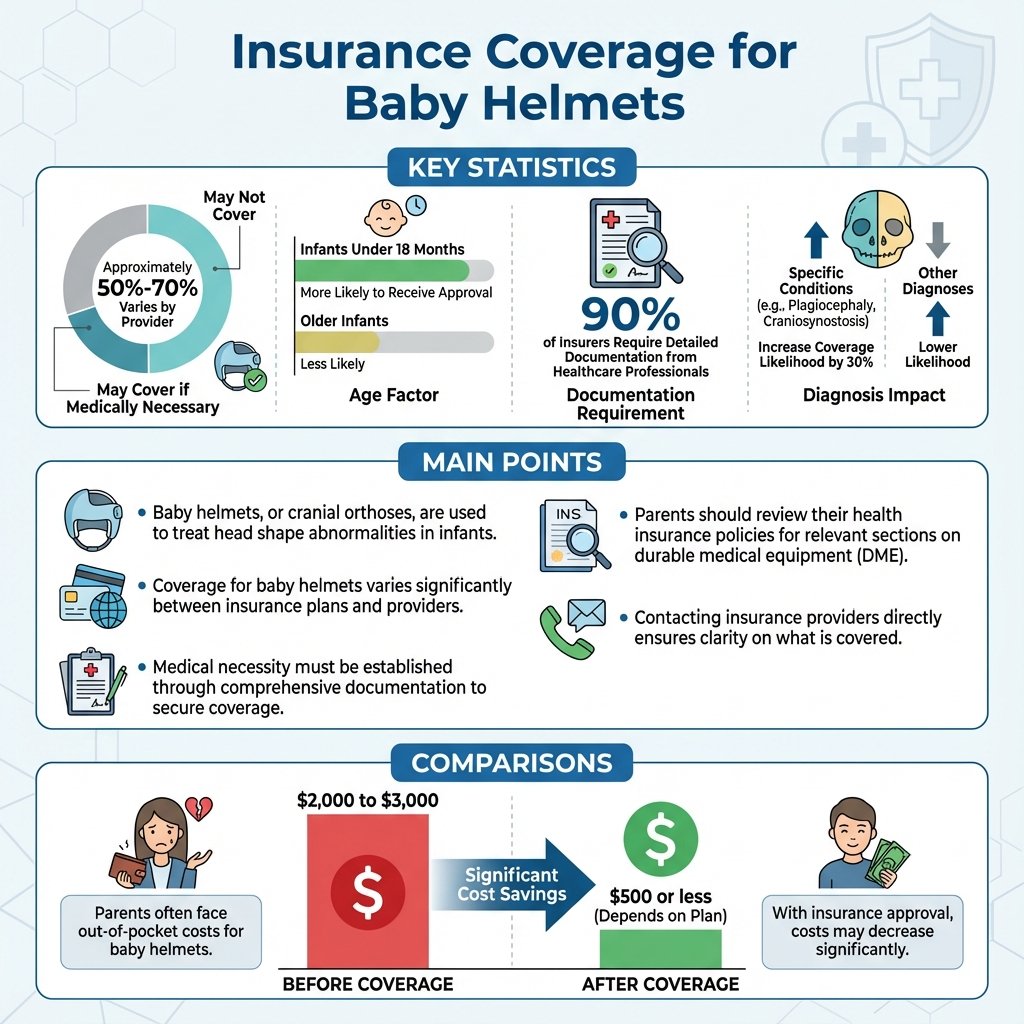

Many parents wonder if baby helmets are covered by insurance, and the answer is: it depends on your insurance plan. Some insurance providers may cover the cost, especially if a medical professional deems it necessary for conditions like plagiocephaly. Understanding the nuances of coverage can help you navigate the costs effectively, ensuring that you are well-prepared for potential expenses related to your child’s treatment.

Understanding Baby Helmets

Baby helmets, also known as cranial orthoses, are specialized devices designed to treat head shape abnormalities in infants. These helmets are primarily recommended for conditions such as positional plagiocephaly (flat head syndrome) and craniosynostosis, where the skull bones fuse prematurely, limiting the skull’s growth. The purpose of these helmets is to gently reshape the baby’s head by applying slight pressure to specific areas while allowing growth in others. Pediatricians often suggest a baby helmet for infants diagnosed with these conditions, emphasizing early intervention as a key factor for successful treatment.

The process of getting a baby helmet typically begins with a thorough assessment by a pediatrician or a specialist in pediatric neurology. If a head shape abnormality is identified, the doctor may refer the child to a facility that specializes in cranial orthoses, where the child will undergo a fitting process. This involves taking precise measurements of the baby’s head to create a custom helmet that fits comfortably and effectively.

Insurance Coverage Basics

Insurance coverage for baby helmets can vary significantly between different plans and providers. Some health insurance policies include coverage for cranial orthoses if they are deemed medically necessary, while others may not cover them at all. Factors influencing coverage include the specific diagnosis, the age of the infant, and the overall treatment plan recommended by the healthcare provider.

To understand your specific coverage, it is essential to review your health insurance policy in detail. Look for sections that discuss durable medical equipment (DME) or pediatric specialty services, as baby helmets may fall under these categories. Additionally, contacting your insurance provider directly can provide you with the most accurate and up-to-date information regarding coverage options.

Medical Necessity and Documentation

One of the critical aspects of securing insurance coverage for baby helmets is demonstrating medical necessity. Most insurers require comprehensive documentation from a healthcare professional to approve coverage for cranial orthoses. This documentation typically includes a formal diagnosis, a detailed treatment plan, and possibly even photographs or measurements of the infant’s head.

A strong claim for coverage may include a letter from the child’s pediatrician or specialist outlining the medical necessity of the helmet, why it is the recommended treatment, and the expected outcomes. This documentation is essential for persuading insurance companies to approve claims, as they often rely on medical evidence to validate the need for such devices.

Cost Considerations

The cost of baby helmets can be substantial, typically ranging from $1,500 to $3,000 depending on the provider and the specific features of the helmet. These costs can be a significant financial burden for many families, making insurance coverage a crucial aspect of the decision-making process.

When assessing the financial implications, it is important to consider not only the upfront costs of the helmet but also any additional expenses that may be incurred during the treatment process, such as follow-up visits and adjustments. Understanding your out-of-pocket costs, including copayments and deductibles, can help you prepare for the financial impact and plan your budget accordingly.

Steps to Take for Coverage

To navigate the insurance landscape effectively, there are several steps you can take to secure coverage for a baby helmet. First, contact your insurance company to inquire specifically about coverage for cranial orthoses. Ask about the documentation required, any pre-authorization processes, and any potential out-of-pocket costs.

Next, gather the necessary documentation, including a prescription from your healthcare provider and any diagnostic reports that support the medical necessity of the helmet. If possible, obtain a letter detailing the treatment plan and the expected duration of wearing the helmet. Having all the required documentation organized can streamline the claims process and improve the likelihood of approval.

Common Misconceptions

There are several common misconceptions surrounding insurance coverage for baby helmets that can lead to confusion for parents. One prevalent belief is that all insurance plans automatically cover cranial orthoses; however, this is not always the case. Many plans have specific criteria that must be met, and not all providers recognize flat head syndrome as a qualifying condition for coverage.

Another misconception is that parents will be fully covered without understanding high deductibles or copays that may apply. It is crucial for parents to carefully review their insurance policies and have candid discussions with their providers to clarify coverage details fully.

Alternative Financial Assistance

If your insurance coverage is denied or falls short of covering the full cost of a baby helmet, there are alternative financial assistance options to explore. Many helmet manufacturers offer payment plans that can help families manage the costs over time. Additionally, some non-profit organizations and advocacy groups specialize in supporting families dealing with cranial orthoses and may provide resources or financial aid.

Researching these alternatives can provide peace of mind for families facing financial challenges related to their child’s treatment. Utilizing community resources and support networks can make a significant difference in managing the financial burden of a baby helmet.

In conclusion, while some insurance plans may cover baby helmets, understanding the specifics of your policy is essential. Gathering the necessary medical documentation and being proactive in communicating with your insurance provider can increase your chances of obtaining coverage. If insurance coverage is insufficient or denied, exploring alternative financial assistance options can help alleviate the financial burden. By taking these steps, parents can ensure that their children receive the necessary treatment for head shape abnormalities without undue financial stress.

References

- https://www.cdc.gov/ncbddd/childdevelopment/positiveparenting/infants.html

- https://www.healthychildren.org/English/health-issues/conditions/Head-Injuries/Pages/Helmet-Treatment-for-Plagiocephaly.aspx

- https://www.aap.org/en/patient-care/infant-helmet-therapy/

- https://www.nichd.nih.gov/health/topics/brain/conditioninfo/treatment

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6220895/

- https://www.cchfreedom.org/issue/health-insurance-coverage-helmet-therapy/

- https://www.verywellfamily.com/what-is-a-baby-helmet-4171529

- https://www.chop.edu/conditions-diseases/plagiocephaly-helmet-therapy